The latest study by the Federal Reserve Bank of San Francisco (FRBSF) draws unexpected conclusions that almost make you believe a disgruntled Fed employee did it. But be assured, it’s an official study published on the FRBSF website (here is a link to the actual research report posted on the FRBSF website).

The study analyzes and quantifies the effect of large-scale asset purchases (LSAPs), also known as quantitative easing (QE) and lower interest rates, on the economy and inflation.

The results are uncharacteristically frank and seemingly self-defeating, but the intent of this study may just be brilliant (more below).

The study is about 5 pages long and can be summarized roughly by a few paragraphs.

The final conclusion is that: "Asset purchase programs like QE2 appear to have, at best, moderate effects on economic growth and inflation.”

How moderate? "A program like QE2 stimulates GDP growth only about half as much as a 0.25 percentage point interest rate cut.”

How much does a 0.25% rate cut boost the economy? "GDP growth increases about 0.26 percentage point and inflation rises about 0.04 percentage point.”

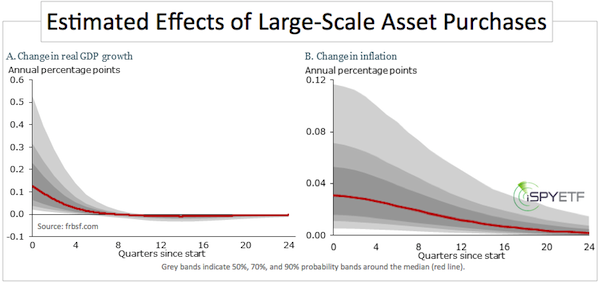

In other words: "QE2 added about 0.13 percentage point to real GDP growth in late 2010 and 0.03 percentage point to inflation.” (see chart)

Furthermore, the study states that: "Forward guidance (referring to the low interest rate policy) is essential for quantitative easing to be effective.”

In other words, QE only works in conjunction with a low interest rate policy. The federal funds rate, the rate banks charge each other to borrow money deposited at the Fed, is already near zero. The 10-year Treasury yield (Chicago Options: ^TNX) is just coming off an all-time low.

It is no longer possible to ‘supercharge’ QE with ZIRP.

-iSPYETF - Yahoo Finance